Navigating the fluctuating world of equities can be complex. For investors seeking focused exposure to particular segments of the market, S&P 500 Index ETFs present a compelling opportunity. These ETFs replicate the performance of firms within specific sectors of the S&P 500 index, providing investors with a efficient way to engage in trending industries.

Understanding the historical performance of these ETFs is essential for making informed investment choices. By analyzing movements in various sectors, investors can discover potential opportunities and minimize risk.

This article explores the performance of different S&P 500 Sector ETFs, providing insights into their weaknesses and possibility for future growth.

Revealing the Top-Performing S&P 500 Sector ETFs in 2023

The dynamic S&P 500 has displayed a fascinating year in 2023, with certain fields excelling others. For traders seeking to capitalize from this trend, sector-specific ETFs provide a strategic approach.

This article will delve the top-performing S&P 500 sector ETFs of 2023, analyzing their results and emphasizing the drivers behind their success.

If you are a seasoned professional or just beginning your investment journey, understanding these top performers can offer valuable information on the present market dynamics.

- Top Sector ETFs to Watch

- Key Performance Driving Success

- Elements Influencing ETF Choices

Navigating the Landscape: Best S&P 500 Sector ETFs for Your Portfolio

Embarking on your investment journey within the dynamic market of the S&P 500 can feel overwhelming. With its vast array of companies spanning diverse sectors, choosing the right investments is vital. Sector-specific ETFs offer a strategic approach to capitalize Sector ETFs performance on growth within particular industries. Consider these leading S&P 500 sector ETFs to diversify your portfolio:

- Consumer Discretionary - For exposure to the ever-evolving digital sector, consider ETFs like XLK. This popular ETF tracks a broad range of technology giants.

- Energy - Tap into the robust financial sector with ETFs like XLF. This well-rounded selection encompasses banks, insurance companies, and more.

- Materials - Seek stability with ETFs like XRE, which tracks the performance of real estate investment trusts (REITs).

Before making any allocation, conduct thorough research and consider your risk tolerance. Remember that diversification is key to managing risk and building a resilient portfolio. Seek guidance from a qualified financial advisor to tailor your investment strategy to your unique needs.

Asset Allocation Strategies with S&P 500 ETFs

Sector rotation is a dynamic investment approach where investors shift their holdings among different sectors of the stock market based on prevailing economic conditions and performance trends. Portfolio managers employing this strategy aim to capitalize on cyclical shifts within the S&P 500, a benchmark index tracking the performance of 500 large-cap U.S. companies.

By deploying ETFs (Exchange-Traded Funds) that track specific sectors, investors can effectively execute sector rotation tactics. For example, during periods of economic expansion, investors may prefer ETFs focusing on cyclical sectors such as technology. Conversely, in a slow-growing economy, defense sectors might interest to investors seeking more stable assets.

- Careful monitoring of economic indicators and market trends is crucial for identifying potential sector rotation opportunities.

- Asset Allocation across multiple sectors can help manage overall portfolio risk.

- Historical performance is not indicative of future results, and investors should conduct comprehensive research before implementing any investment strategy.

Exploring in S&P 500 Sector ETFs: A Comprehensive Guide

Unlocking the power of the S&P 500 through sector-specific exchange-traded funds (ETFs) can be a intelligent move for financiers. These specialized ETFs target on particular sectors within the S&P 500, allowing you to tailor your portfolio based on defined market segments. Before diving in, it's essential to comprehend the characteristics of each sector and how they may fluctuate over time.

- Carry out thorough research on different sectors, considering factors like expansion prospects, stability, and present market trends.

- Diversify your investments across multiple sectors to mitigate risk and create a more balanced portfolio.

- Observe your ETF holdings regularly, making adjustments as needed based on outcomes and market shifts.

By following these guidelines, you can profitably invest in S&P 500 sector ETFs and work towards achieving your financial goals.

Exploiting Potential: Sector-Specific Investing Through S&P 500 ETFs

Navigating the vast landscape of the investment universe can be a daunting task for investors. With the ever-shifting tides of economic trends and market dynamics, achieving consistent, meaningful returns requires a strategic approach. Some of investors are turning to focused portfolios as a means to enhance portfolio performance. By diversifying within specific sectors, these ETFs provide avenues to tap into unique growth stories and potentially surpass market benchmarks.

- Leveraging the inherent risks and rewards of niche markets can be a valuable strategy for growth-oriented portfolio managers seeking to differentiate their portfolios.

- Understanding the future outlook of a sector is crucial before allocating assets.

- By conducting thorough research, investors can identify promising sectors and generate consistent returns.

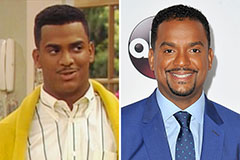

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!